By JAN McLAUGHLIN

BG Independent News

Bowling Green City School District is asking voters to support a 0.75% continuing income tax in November to support daily operations. If passed, it will be the first new operating levy for the district since 2010.

“That’s been 14 years, which is a long time for a school district to not have new operating dollars passed by its community,” Superintendent Ted Haselman said.

Haselman is a numbers guy – and the numbers tell the story. Since the last new operating levy was passed in 2010, school revenue has gone up an average of 1.75% annually. School expenditures have gone up 2.42% annually. And inflation has outpaced them both, pushing up 3.18% annually.

“It’s hard to keep up,” Haselman said. “The district has done a good job controlling costs to the best of our ability.”

“This is a need – not a want,” he said of the income tax issue. “It’s been 14 years.”

And it shouldn’t come as a shock to voters, Haselman said. “It’s been discussed openly for at least three years. It’s not a surprise, we’ve known it was coming.”

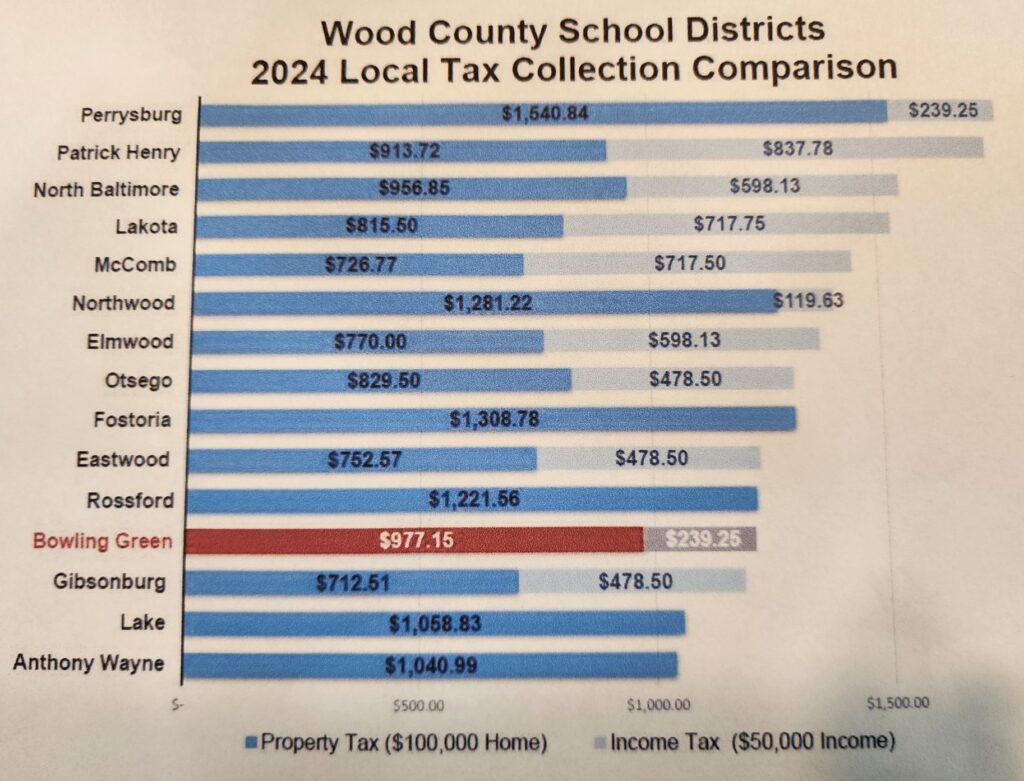

District officials point to a chart comparing local tax collections for 15 area school districts. Bowling Green is ranked fourth from the bottom, and has one of the lowest income taxes in the area at 0.5% currently.

“Hopefully it will show some growth so it can keep up with inflation over time,” Haselman said of the income tax revenue.

BG school officials are quick to note that the operating levy would not tax seniors’ Social Security benefits, disability or survivor benefits.

Haselman pointed to the district’s most recent state report card as proof that Bowling Green is providing a top-notch education for students. BG improved its overall score, ranking it above every district in the county except Perrysburg.

“We do provide a great education for kids,” the superintendent said. “We do provide a really good service for the community.”

School officials have heard the questions of why the district needs more money after it just passed a bond issue last fall to build a new high school. Haselman points out that bond money can’t be used for daily operations, which include expenses like personnel costs, classroom supplies, facilities maintenance, textbooks, technology, transportation and utilities.

“This is how school funding works in Ohio,” he said.

And that means if this operating levy fails, Bowling Green City Schools will be forced to make cuts to people and programs. Close to 80% of the district budget is for personnel – who are needed to provide the variety of class options currently available.

“We would not be able to offer the same programs,” Haselman said.

At the same time that inflation has outpaced revenue, the district has also seen its state funding reduced. Bowling Green has worked to secure nearly $2 million in grants to offset expenditures.

Haselman makes the case by comparing today’s costs to the expenses from a decade ago of educating 2,700 students with about 450 staff, while maintaining five schools and two support buildings.

It now costs more than $105,000 a day to run the district, compared to $79,000 a decade ago. Starting salaries for teachers have increased from $33,000 to $48,000 over the decade, and the cost of a new bus has gone from $84,000 to $134,000.

The levy effort is being supported by BG Families for Schools – the same group that rallied the community last year to pass the bond issue for the new high school. Haselman and members of this group have been taking their message to service organizations and coffee shops – to anyone willing to listen.

“Bowling Green hasn’t passed a new operating levy since 2010. That’s 14 years. It’s no wonder we currently rank near the bottom of schools in Wood County when it comes to our school district income tax. This levy would put us right in the middle – neither the highest nor the lowest. It’s a fair proposal that’s badly needed,” according to BG Families for Schools.

“We don’t need to look far to see the negative effects that occur in communities that reject operating levies,” the organization pointed out, listing Perrysburg, Anthony Wayne, Otsego and Napoleon as districts facing cuts due to failed levy requests.

“When communities don’t pay to operate their schools, teachers lose their jobs and students pay the price,” with consequences such as teacher layoffs, fewer course offerings, cuts to after-school activities, and bigger class sizes.

“We’re working hard to make sure we don’t have to cut Spanish, other foreign languages and other courses,” Ryan Phipps said during one of the BG Families for Schools’ weekly meetings.

“We have smart kids and effective sports programs,” and voters need to support them, said Trevor Jesse, another member of the family group.

The district has made big steps in improving communication about student successes, said Rachel Phipps.

“I really feel like more people are hearing about what is going on in our schools,” she said.

After last year’s bond issue success following several failed attempts, Jeff Dennis said he believes the community will support the operating levy.

“Last year the entire community recognized we were facing a lot of challenges,” Dennis said. “I’m very optimistic. People in the community want to be a part of it, and be a part of the success.”

“Ultimately this is a need, not a want,” said Nate Spitler.

Following is more information about the operating levy request: