By JAN LARSON McLAUGHLIN

BG Independent News

Bowling Green City Council unanimously approved a tax increase that will have out-of-town guests paying to promote the city to more visitors.

Council voted Monday to enact an additional 1 percent hotel/motel tax, with the revenues dedicated to the Bowling Green Convention and Visitors Bureau. Council also approved a three-year renewal of the current 3 percent hotel/motel tax, with the CVB continuing to get 60 percent of that tax revenue and the city getting 40 percent.

Wendy Chambers, executive director of the Bowling Green Convention and Visitors Bureau, said the additional funds will help fill hotel beds, restaurants and stores.

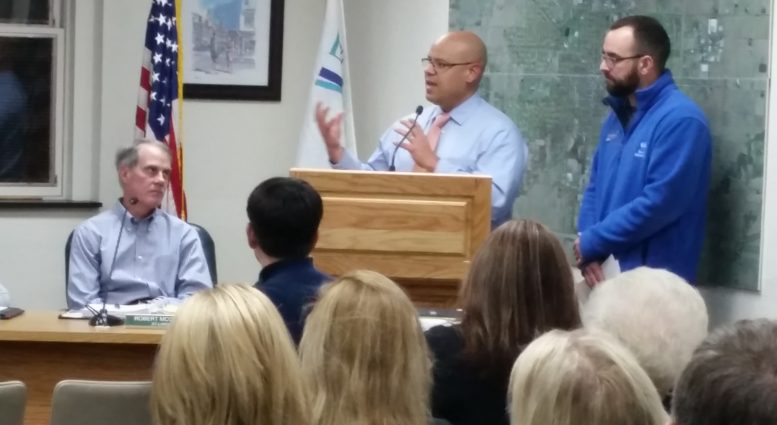

The hotel tax increase has the support of all the hotels owners in the city, according to Todd McGee, vice chairman of the CVB and general manager at the newly remodeled Best Western Falcon Plaza. The tax will be paid by visitors to local hotels and motels, and would have no impact on city residents, he said.

Bowling Green is a big destination for sporting events, with regional youth athletics and BGSU sports filling up local hotels, McGee said. Events such as the Black Swamp Arts Festival, National Tractor Pulling Championships, and concerts also draw overnight guests to the city. But weekday business is lacking.

Hotels are the concierge for Bowling Green, McGee said. They send guests out into the city with recommendations of restaurants to dine in and shops to visit.

The timing for the tax increase is great, McGee said, with several businesses investing in Bowling Green including his hotel which just spent $1 million on renovations. A new Fairfield Inn recently opened, and another hotel will be constructed next year.

“It’s a good time to be in Bowling Green,” McGee said.

But to be competitive with other destinations, Bowling Green needs to keep attracting more sports tournaments, conventions, tours and other events.

“Our goal is to continue growing Bowling Green tourism by taking this to the next level,” McGee said. “We have to keep driving that stuff to Bowling Green.”

That means sending Chambers out to more events where she meets face-to-face with groups scheduling tours, conventions or tournaments. Patrick Nelson, co-chair of the CVB board and director of the BGSU student union described the process as “speed dating for businesses.”

Bowling Green currently has about 500 hotel rooms. Once the Home 2 Suites hotel is built next year, there will be close to 600 rooms. That addition will mean Bowling Green can make bids for bigger events, Chambers said.

Council member Scott Seeliger asked how businesses will measure the success of the enhanced efforts and “branding” of the city.

“Your measure is the revenue line,” Nelson said. Success can be measured by the number of hotel rooms being rented, which is followed by more money being spent at local restaurants and stores.

“Obviously, we all know a tax is a tax,” Nelson said. The additional tax will only mean $1 for each hotel room rental. “But overall it’s going to help us tremendously.”

Council member Sandy Rowland, who is also a member of the CVB board, said it is significant that all the hotel owners in the city support the tax increase.

“They are the ones putting themselves on the line,” she said.

One of the goals is to bring more weekday visitors into the city.

“We seem to have no problem filling rooms on the weekends, but we have to fill them during the week as well,” Rowland said.

When it came time for the vote, Rowland put in one more plug for the hotel/motel tax increase.

“This money is coming from a tax that is only coming from visitors paying for hotel rooms,” she said.

Rowland mentioned that some discussion was held about the city keeping a portion of the additional 1 percent tax for the city’s general fund. But the approximate $75,000 is needed by the Convention and Visitors Bureau, she said. “That’s something the CVB needs to help us grow.”

Council member Bob McOmber said he had some reservations about the additional tax going entirely to the CVB, when the tax has always been shared with the city in the past.

“That gives me some concerns,” he said. “We’re foregoing an opportunity to make a relatively small increase in the general fund.”

Council member John Zanfardino had previously expressed similar concerns, but was not present at Monday’s meeting.

However, McOmber also noted the support of the hotel owners. The last time a hotel/motel tax increase was introduced, the owners did not favor the proposal. But that proposal included sharing the tax revenue with the city general fund.

McOmber also said that if the branding and promotion efforts are successful, then the city overall will benefit.

Council member Bruce Jeffers agreed. “I like to think of this as an opportunity to invest.”