By JAN McLAUGHLIN

BG Independent News

Bowling Green Board of Education accepted the resignation of its school treasurer Tuesday evening following an executive session. That leaves the board in a difficult position as it prepares to put a tax issue on the November ballot to reverse the district’s deficit spending.

The need for some type of tax issue on the fall ballot is no surprise. The last time the school district asked voters for new operations money was 2010.

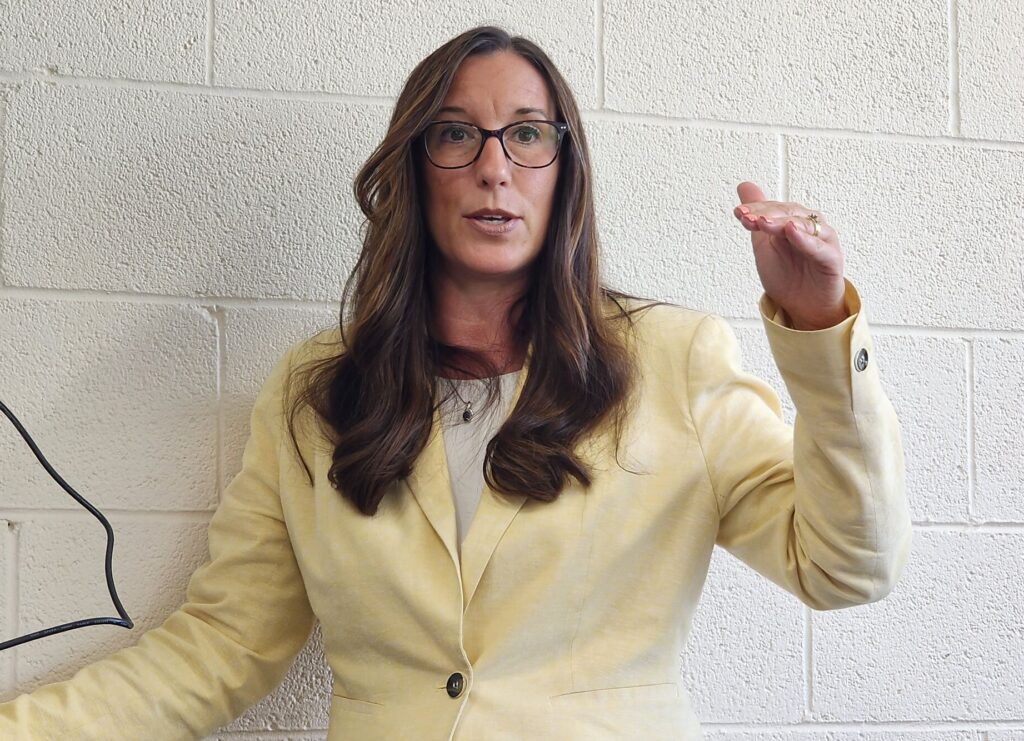

“We knew we would have to go to the voters in November,” school board President Tracy Hovest said.

But it was a surprise that the board would have to make a decision on the type and amount of the levy without their treasurer.

Cathy Schuller’s contract was not renewed by the board earlier this spring, but she was to remain in the treasurer’s position until July 31. During Tuesday’s meeting, Schuller presented the district’s five-year budget forecast to the board, showing the district needed to place some type of tax on the November ballot.

Board members expressed frustration when Schuller was asked to calculate how different income tax levels would affect the budget, but she declined, saying the new treasurer may have a different forecast.

Board members pushed back, saying numbers are numbers, regardless of who is in the treasurer’s position, and they needed the information to decide how much to ask of voters.

Schuller replied it would “make more sense to have your new treasurer” provide that information.

But the deadlines for placing tax issues on the November ballot are the end of July 26 for income tax issues and Aug. 7 for property tax levies. The new treasurer, Matt Feasel, does not start the job until Aug. 1.

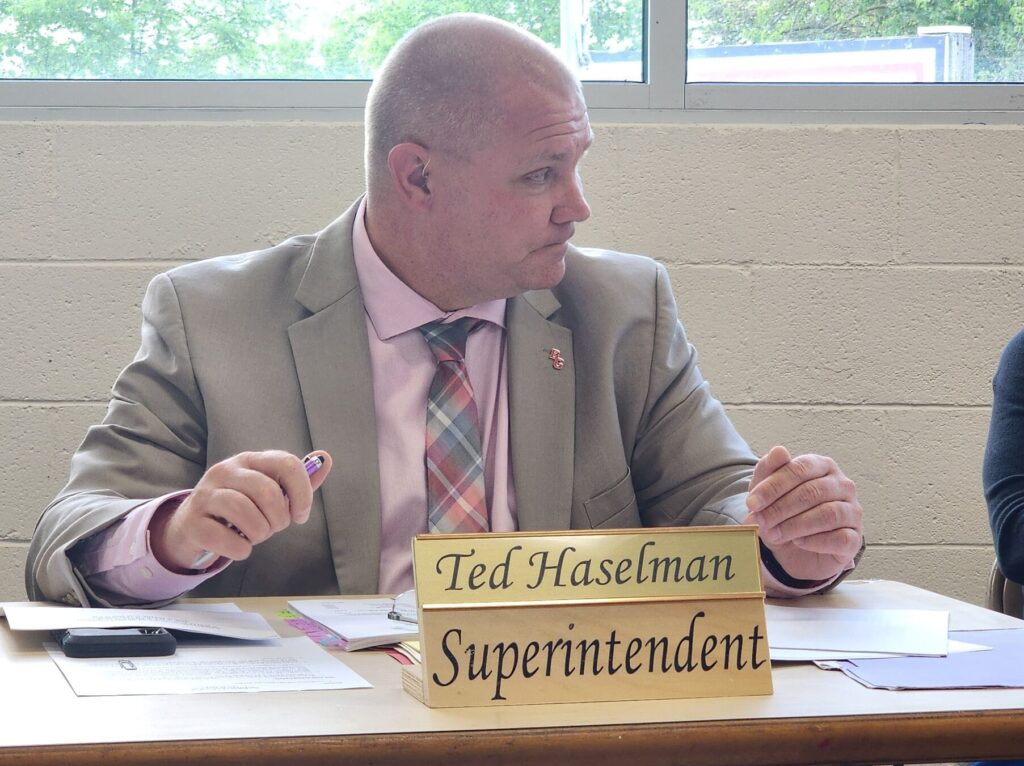

“We don’t have time for that,” Superintendent Ted Haselman said.

After the executive session, the board voted to accept Schuller’s June 3 resignation, which she reportedly submitted to the board in a letter last week. The board also voted to employ assistant treasurer Richelle Oberlin in the treasurer’s position from June 3 to July 31. During that period, Feasel will act as a consultant.

Hovest said the board will get the information it needs to make a decision on a fall ballot issue.

“I’m confident in our team,” Hovest said. “We will make an informed and correct decision to move this district ahead – whether Cathy gives it to us or not.”

During the meeting, which was held in Portage Village Hall, Hovest expressed her preference for putting an income tax on the ballot.

“On the heels of just passing the property tax (for the new high school), I don’t know if it’s wise to go for a property tax again,” she said.

The district currently has a 0.5% income tax in place. School districts can only increase income taxes by quarter increments. A 0.25% income tax would generate an estimated $2.2 million, a 0.5% income tax would bring in $4.4 million, and a 0.75% income tax would generate $6.5 million.

According to Schuller’s calculations, the district would be in a deficit again in two years if it passed a 0.25% income tax in November.

“We’d be right back where we don’t want to be,” Haselman said.

Schuller explained earlier in the meeting that the revenue of the district is not keeping up with expenses due to a variety of factors. Income tax collections were down slightly last year, interest rates are flat, enrollment has declined, and expenses continue to rise with the costs of services and supplies up 26%.

Other factors that could affect the district include possible resolution of Rover Pipeline challenges in court, “fair school funding” in the state, possible property tax reform, and COVID assistance funding coming to an end.