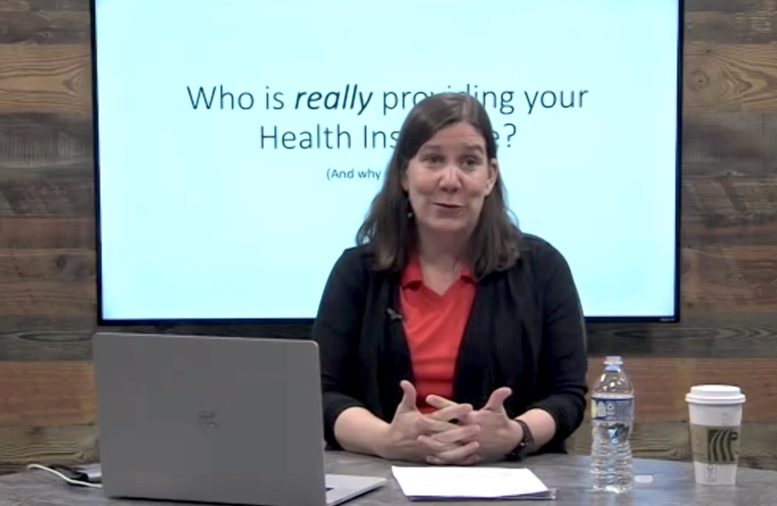

By JULIE CARLE

BG Independent News

The distinction between public and private health insurance in the United States is not as different as most Americans might believe.

“The majority of people’s health costs are managed by private insurers even if they are in Medicare or Medicaid,” said Dr. Amanda Cook, associate professor of economics at Bowling Green State University, during a virtual BGSU Science Café Tuesday evening (3/14).

Medicare and Medicaid were developed in the 1960s with a social function to protect older people and children. “There has been a shift since then and the government has relied more and more on the private market to administer plans,” she said.

Significant changes in the industry have happened over several decades that mainly started in the 1990s, the decade of the “managed care revolution,” she explained. At the beginning of the decade, approximately 8% of plans had managed care and by the end of the decade that number skyrocketed to over 90%.

“Managed care, which was absolutely intended to contain costs, has become the new framework for thinking about health insurance,” Cook said. In a managed care system, “the insurers network with preferred providers for a much lower cost for their enrolled individuals.”

Insurance companies such as Aetna, Anthem, Cigna, United HealthCare and Kaiser are the familiar names in the industry and the ones that are providing the majority of coverage in the U.S. Because these insurers are so big, they do a good job of negotiating lower rates for consumers, Cook said. “A critical function of these insurers is to negotiate rates and allow individuals to access the rates that they couldn’t get on their own.”

Managed care impacted both the private sector and the public sectors. In 2007, there were 8 million individuals enrolled in Medicare Advantage plans, which are designed for Medicare enrollees but are run through a private firm. In 2022, there were 28 million people in Medicare Advantage plans.

The Medicaid numbers have seen similar increases with 16 million individuals covered under Managed Care Organizations in 2003 compared to 58 million Americans in 2020.

“You are looking at a huge increase over the last 15 years,” Cook said. “I’m not arguing that this is bad per se. Insurers are really good at what they do, but the notion that Medicaid is a public program is really a misnomer.

“We are to a place now where public plans are mostly run by private insurers. We have to consider if the objectives of a public health plan – like Medicare and Medicaid, align with private health insurers objectives where private health insurers are traded on the stock market and have an obligation to their stockholders to be generating profit,” she said.

Back to the basics

Health insurance is a mechanism designed to protect households from the financial impact of injury, illness and disability, by transferring risk from the household to the insurer.

Health insurers have three primary functions, according to Cook:

- Pool and bear risk.

- Process claims.

- Negotiate networks and rates.

Insurance is often viewed today as primarily covering catastrophic health events that are low frequency but high severity. “But even if you don’t ever file a claim, what you get is peace of mind that in the case of a bad outcome, you will be protected financially,” Cook said.

Health insurance functions as a traditional (big event) insurance and as a prepaid component, “which is the part that makes it so expensive,” she said.

Health expenditures are growing even faster than inflation. According to Cook, for every healthcare dollar, 50 cents is for hospital care, 33 cents covers doctor visits and about 16 to 17 cents are for prescription expenditures.

“We can see that over half of our insurance dollar is going for things we wouldn’t think of as ideally insurable,” she said.

More employers become self-insured

Another change in health insurance has been that as health costs have been rising faster than inflation, many employers, where the vast majority of Americans get their health care coverage, have become self-insured. Thus, employers are holding on to the financial risk that they used to transfer to insurance companies.

The phenomenon of employers providing health insurance started during World War II when wages were frozen. “Employers offered health insurance as a benefit in lieu of higher wages,” Cook said. When people weren’t paying full price for health care, it triggered them to seek more care, which in turn, triggered increases in healthcare costs.

It has become increasingly difficult for employers to get fully insured plans at a price they find acceptable.

“When your employer is holding all of this risk, and they are trying to lower cost, then we are in a situation that is a little bit sticky, The employer is going to change the plan generosity. They might increase the deductible or they might increase the out-of-pocket max that the individual is going to have to pay,” Cook said.

Often people don’t realize they are in a plan where their employer is self-funding and using an Administrative Services Only (ASO) contract.

“When we think of people’s understanding of their benefits, you might feel differently about your employer being financially responsible for your medical expenditures instead of a big-name insurer,” she said. It is likely if health insurance is through Aetna, Anthem or Cigna that the plan is an ASO contract.

What also happens in an employee self-insured plan is that the insurers have moved the risk to the employers and the employers are transferring that risk back to the households. “We are in a situation where insurance isn’t serving the essential function of transferring risks which leads to complicated social problems,” she said.

“How do we protect households? How do we support our socially vulnerable populations? How do we create a system that promotes health and well-being?” she said. “I think the answer is through regulation. Thinking about our healthcare system and how we create an environment that supports people being healthy feels important to me.”