By JAN LARSON McLAUGHLIN

BG Independent News

Ideally, budget forecasts should not look like abstract art.

But despite a couple funds showing diverging lines, Bowling Green’s city budget is pretty solid – almost boring. And boring is good.

“I think this is a really solid budget,” City Council President Mike Aspacher said last week at a city finance meeting. “There’s not a lot of glamorous ideas,” but it does maintain core services and plans ahead for future projects, he said.

Mayor Dick Edwards agreed the 2019 budget wasn’t flashy, but could be described as a “continuation type budget.”

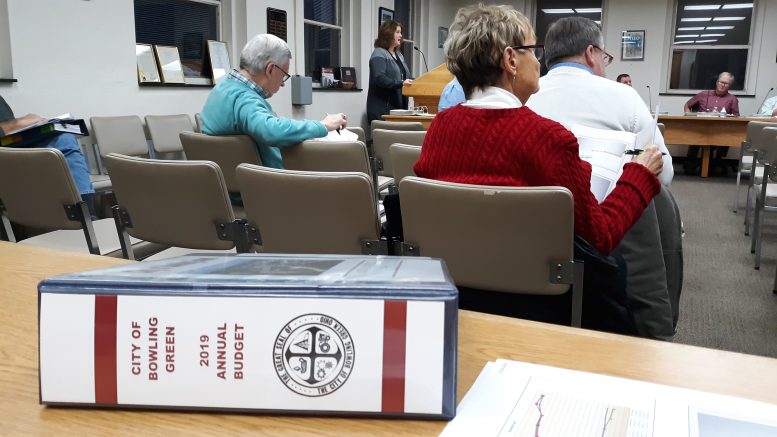

City Council and department heads gathered last week for a presentation on next year’s budget by Municipal Administrator Lori Tretter.

“The revenue for 2019 in the general fund is flat,” Tretter said. The end of some grant funding was balanced out by an increase seen from the new garbage/recycling fee, income tax revenue being up a bit, a workers compensation refund, and interest income which “continues to come in very well.”

The proposed revenue for the city’s general fund in 2019 is $16.4 million. The projected expenses are greater, at $16.6 million.

The general fund balance expected in 2019 is $3.1 million – lower than the city’s targeted fund balance of $4.1 million.

But Tretter assured council members that the city will not need to make cuts in core services.

“We will be able to continue maintaining the core services of the community,” she said.

City officials also plan to provide funding for some expenses suggested in the new Community Action Plan, for items like a zoning ordinance review, and microgrants to the community.

And the city continues to put aside some money in each annual budget for 2021, when the city will have 27 rather than 26 pay periods.

Tretter said the city is not creating any new employee positions for next year. However, she mentioned that the city expects several retirements next year – especially in the police and fire divisions. The city hired several fire and police employees in the 1990s after the passage of a couple safety levies. Some of those employees are now reaching retirement age. The positions will be replaced, she said.

Tretter also talked about various city funds. The street construction and maintenance fund is “particularly challenging to us.” The graph showed a “big red spike” last year for a paving program, followed by flat revenue and a decreased balance.

The parks and recreation fund is being affected by plans to demolish older buildings in City Park and replace them with one new structure. So in addition to borrowing money for the new building, the city currently can’t make money off of renting or programming in the old buildings.

“We are cautious, but we do see light at the end of the tunnel,” Tretter said, noting that once the new building is in operation, the city can expect some income from it.

Because the parking funding continues to see a decline, the city is studying the downtown parking issue. The expenses in the parking fund spiked with the paving of City Lot 2 in 2017.

The police and fire levy funds are doing fine, with expenses in line with revenue.

Spikes are being seen occasionally in the sewer and water capital improvement fund.

“This community has accomplished so much through the sewer and water capital improvement fund,” Tretter said.

The city continues to try putting money away in its reserve fund for large projects like a new fire engine, equipment for the arborist, and information technology items. A fire engine can cost anywhere from $500,000 to $1.2 million. The repair costs on the aging engine are getting quite costly.

The city is also dealing with some aging facilities, Tretter said. For example, the police division is in need of a new HVAC system.

“If we don’t pay attention to them, they can end up costing us more money,” she said. “There’s a lot to balance when putting together a budget.”

The city may try something new with its vehicle fleet, by leasing some of them. The city’s practice has been to pay cash and then use vehicles till they are worn out.

“We tend to keep them for a long time,” Tretter said.

But officials will be looking at a leasing strategy for some vehicles.

Tretter went over a pie chart showing how each $100 of income tax revenue is distributed:

- $37.50 to the general fund.

- $25 to the sewer and water capital fund.

- $18 to the fire fund.

- $7 to the police fund.

- $6.25 to the capital fund.

- $3.75 to the street repair fund.

- $2.50 to the recreation fund.

Some of the goals adopted earlier this year continue into next year:

- Community Action Plan, working on the transition from planning to implementation.

- East Wooster corridor.

- Historic preservation, working on legislation and forming a commission.

Also on the schedule for next year is the paving of downtown streets and restoring the brick at the four corners, repaving of Thurstin and Pike streets, repaving of South Main Street, and a roundabout at Campbell Hill and Napoleon roads.

“We know we have a lot of roads to care for,” Tretter said.

Tretter said the city is “very cautious in the way that we approach debt.”

City Finance Director Brian Bushong explained it further.

“We are far below our debt capacity,” he said. “All the places say we could borrow more money.” But the city is not interested in incurring great debt.

At the end of the budget presentation, some council members had questions. Bruce Jeffers asked about the “ancient” city office building.

“I wonder why we aren’t talking about this building anymore,” Jeffers said.

Tretter explained that the city is waiting for the senior center to move to its new location. A site analysis has been funded for the space for 2019.

Council member Sandy Rowland asked about efforts to extend the life of Oak Grove Cemetery. Tretter said there is nothing in the 2019 budget for the cemetery, though policy changes are being considered.

Jeffers also expressed some concerns about the state taking away the “kilowatt hour tax” that could cost the city $1.8 million.

“That would be a disaster for us,” he said.

Edwards said he has written to state legislators to express the concern.

The mayor continued to talk about his concern about less funding from the state.

“We can’t bank of promissory notes,” Edwards said. “I’m hoping for a positive change in Columbus. Maybe we’ll see a shift in attitude.”