By JAN LARSON McLAUGHLIN

BG Independent News

Bowling Green City Schools’ new treasurer is not “ultra-conservative.” But even with a brighter outlook, the school district’s budget projection paints a troubling picture for the next five years.

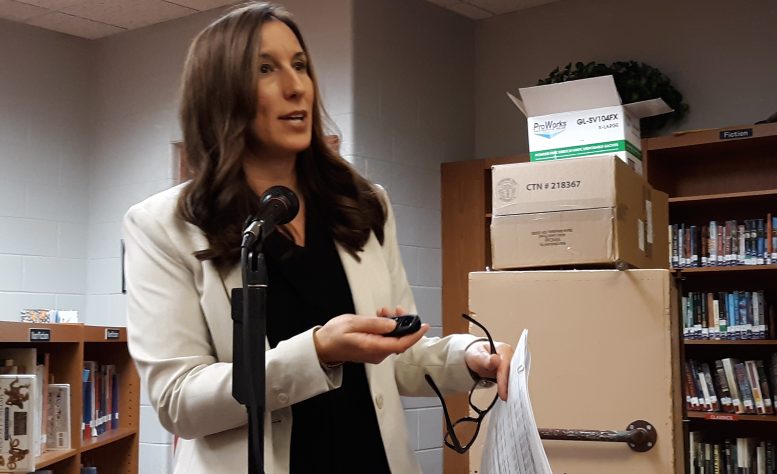

Treasurer Cathy Schuller presented her five-year forecast to the board of education last week.

Schuller described her approach to budget forecasts as conservative – but less so than the previous treasurer’s.

“I like it to be more of an actual planning tool,” she said.

The last forecast had projected Fiscal Year 2018 to end with a $1.3 million deficit. It will actually end $1.24 million in the positive. There isn’t a comfortable cushion – but it’s not in the red, Schuller said.

“We don’t have much of a margin,” she said.

The five-year budget she presented to the board last week also doesn’t have a lot of rays of sunshine.

The district has seen little growth in revenue in 2018. New construction in the district is weak. And the funding from tangible personal property tax has been phased out by the state. The district does still benefit from the state reimbursement of Homestead and rollback on all levies in place.

Income tax revenue saw slight increases, but forecasts call for it to level out. Casino revenue is stagnant.

Interest rates are increasing slowly, but since the district has less money to invest, it likely won’t benefit.

Meanwhile, expenses are going the opposite direction.

“Expense keep going up,” Schuller said. “As the years go on, the expenses start to exceed the revenue.”

The actual revenues for Fiscal Year 2018 are $32.3 million. The actual expenses are $31 million.

The forecasted revenues for 2019 are $32.8 million, compared to expenses of $32.75 million. After that, the projected expenses overwhelm the estimated revenue.

This is where the school district gets its revenue:

- General property tax. Two levies expire in 2019.

- School district income tax. Renewed in 2017, the 0.5 percent levy expires in 2022.

- State Foundation Basic Allowance, based on state funding formula. Unknown future with new governor to be elected.

- Restricted state grants-in-aid. Unknown future.

- Other revenue such as interest, open enrollment credit, property rental, student fees. Increased expenditures reduce funds to invest.

Some funding previously used by the district has been terminated by the state:

- Property tax allocation from Homestead/Rollback reimbursements. Revenue ended in 2017.

- Tangible personal property tax. No longer exists.

The five-year budget projection numbers add up to a downward trend in revenue and an upward trend in expenses.

Certified and classified contracts run through 2019. Negotiations will take place next year, with both contracts projected with negotiated increases and steps.

The district continues to lose more funding than it receives per student on open enrollment losses.

Minimal increases are predicted for supplies and materials.

The district is working to update its aging bus fleet, by replacing two buses per year over the next four years.

Even with a less pessimistic look at the the budget, the bar graph shows revenues steadily dropping as the expenses continue to grow. While the costs and revenues are equal in 2019, they start going in the wrong directions in 2020, and by 2023, the expenditures outdistance the revenues by $10 million.

That means the district will have to dip into its cash balance. Unless new income is found or renewed by voters, Schuller’s predictions show the district’s cash balance being nearly depleted in 2022, and well into the negative by 2023.

“When your expenses exceed your revenue, you have to start dipping into cash,” she said.

That makes the upcoming levy renewals or replacements vital, Schuller said.

Two property tax levies expire in 2019. If those levies aren’t supported by voters, the district will see a loss in revenue beginning in 2021, Schuller said.

The district will also be in critical need of its 0.5 percent income tax renewal or replacement when it expires in 2022, Schuller said. If that isn’t passed, the district will begin seeing effects in 2023.

“Community support is vital,” Schuller said.

But the district can take steps now to prepare for potential problems. Schuller advised that the district limit spending to the revenue available. The district has already been working on that. In Fiscal Year 2019, the appropriations were reduced by $1.3 million.