By JAN LARSON McLAUGHLIN

BG Independent News

The Bowling Green School District financial task force found out Wednesday who is footing the tax bill to support the district.

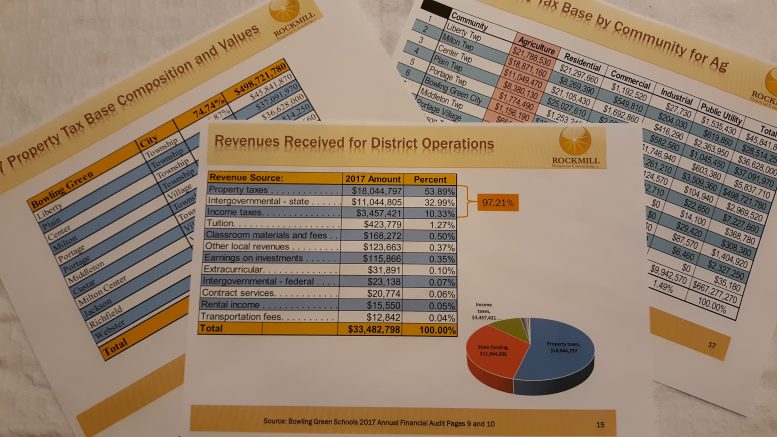

The bulk, 54 percent, comes from property taxes. The next biggest chunk comes from the state, at 33 percent, followed by income taxes at 10 percent.

David Conley, facilitator of the financial task force, said the “vast majority” of school districts in Ohio only have local property taxes. He estimated that out of the state’s 600 school districts, only about 40 have income taxes.

However, several rural districts in this area do have some income tax revenue – including Bowling Green which passed an income tax levy renewal in 2017.

The question that some task force members want answered is – are all local citizens paying their fair share of the property tax pie? Or is the agricultural community being asked to pay too large of a portion.

Conley’s numbers showed the makeup of the Bowling Green City School District tax base is as follows:

- 58.9 percent is residential.

- 24.1 percent is commercial.

- 9.7 percent is agriculture.

- 5.7 percent is industrial.

- 1.5 percent is public utility.

One task force member questioned how the agricultural community feels it is bearing the brunt of property taxes for schools – since the numbers show otherwise. Conley said that the agricultural piece of the pie is being shared by a smaller number of people.

However, it was also pointed out that while agricultural values recently increased significantly, they have since come down some, and are expected to continue that decline. The valuations also sat at very low levels for years before taking the recent jump in value.

Residents also asked for specifics about which residents of which political entities in the district were picking up the tax tab. So broken down by political entities, the numbers showed:

- Bowling Green landowners makeup 74.7 percent of the tax base.

- Liberty Township, 6.8 percent.

- Plain Township, 5.5 percent.

- Center Township, 5.4 percent.

- Milton Township, 4.2 percent.

- Village of Portage, 0.8 percent.

- Middleton Township, 0.4 percent.

- Village of Custar, 0.3 percent.

- Village of Milton Center, 0.2 percent.

- Jackson, Richfield and Webster townships had a combined 0.12 percent.

A great deal of Wednesday’s meeting focused on a 1.7-mill permanent improvement levy originally passed by voters in 1984. The district reduced the amount to 1.2 mills in 1999 and asked voters to approve it as a continuing levy. The voters supported that effort.

The permanent improvement levy generates about $516,000 a year for the district. The school board recently used a portion of the levy revenue to put an addition on the middle school.

Some members of the task force felt that the board had used the funding illegally – or at least improperly – for that addition.

However, Conley said permanent improvement levies can be used to pay for any capital improvements with a life of five years or greater.

“The board had the legal right to do an extension to the building,” he told the task force on Wednesday.

But some continued to question the wisdom of the board to use the PI levy funds rather than going to the voters again for a levy specifically for the middle school addition. Task force member Richard Strow expressed concern that the fund was “crippled” by the board’s decision to use it for the addition rather than save it for maintenance needs. An estimated 60 percent of the levy revenue will go toward paying off the addition for 19 years.

Conley cautioned against using the term “crippled,” since the board has the authority to use funding for priorities – which the addition was determined to be.

Conley also said most school districts do not have permanent improvement levies – the bulk of which is spent on maintenance. It was also mentioned that school districts can transfer money from the general fund for maintenance.

“You’re still ahead of a lot of school districts that have no PI money,” he said.

Task force member Wade Gottschalk said the board was wise to lock in the financing for the middle school addition. Another member, Ben Otley said use of the levy funds for the addition was “completely prudent.”

And task force member Wayne Colvin pointed out the expenses the district faces by using portable classrooms and delaying construction.

Task force member Vicki Venn asked if the citizens can vote to repeal the permanent improvement levy. Conley replied they could do so.

“You have the right as citizens of the community to repeal this tax – any tax that you don’t want to pay,” he said.

However, Conley also talked about the commitment in most communities to share in the expense of resources such as roads, water, fire and police services – and schools.

“That’s part of our existence as a community,” he said. “We’re kind of all in this together.”

Citizens asked Conley to come back to the next task force meeting with some other information, such as how much money is being spent on maintenance on each school building.

Conley said a future meeting of the finance task force will focus on the pros and cons of income and property taxes.

The next finance meeting will be Nov. 14, at 7 p.m. A guest speaker, Steve Roka of the Ohio Facilities Construction Commission, is expected to attend. He will talk about non-traditional financing structures for school districts.