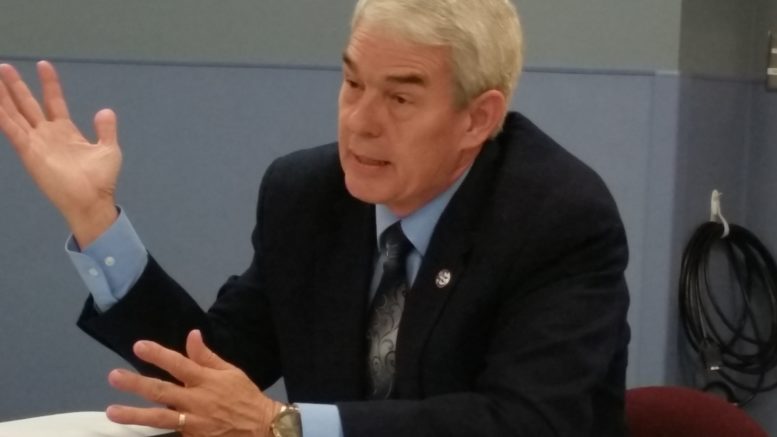

By JAN LARSON McLAUGHLIN

BG Independent News

The “tax shift” cited by some in election seasons, is more of a myth than real math, according to State Senator Randy Gardner, R-Bowling Green.

“You just hardly ever hear the other side of it,” Gardner said recently.

So he decided to provide his own fact checking on the state budget and so-called tax shift.

“Sometimes the truth becomes a casualty of the political season. Such is the case in 2016,” Gardner said.

Across the state, citizens have been told the “tax shift” has required more schools to place levies on the ballot. Untrue, Gardner said.

“In fact, in the past three years, fewer school levies for new operating money have been on Ohio’s ballot than any time in the past 51 years,” Gardner said. According to the state senator, there have been an average of 42 such levies in the past three years. In 2010, Gov. Ted Strickland’s last year in office, a total of 173 new levies were on the ballot. In every year he was governor, more than 100 new levies were voted on in Ohio.

Many people find those stats “unbelievable,” but Gardner pointed out the numbers don’t count bond issues or renewal levies.

“There just hasn’t been the need for new operating money for quite some time,” he said, adding that increases in state funding in the past four years have helped many local schools.

Of the 38 school districts in his senate district of Wood, Fulton, Lucas, Ottawa and Erie counties, only one district (Port Clinton) has had a net reduction in per pupil state funding in the past four years, and three districts are below the rate of inflation in state aid. A total of 25 districts have received greater than triple the rate of inflation increases in new state funding.

Local school districts did lose state funding between 2009 and 2012. According to Gardner, the national recession affected Ohio’s budget and support for schools. Strickland’s last budget cut state revenues to local schools for two years – the first time that had happened in Ohio history – and Governor John Kasich’s first budget experienced similar reductions, Gardner said.

“In fairness, for the most part, state aid has not been a partisan issue in Ohio,” Gardner said, “Governors and most legislators strive to provide funding for local schools, even in times when recessions impact the state budget.”

But a lingering problem seems to be the uncertainty caused by the lack of funding predictability, he said.

“It it challenging for a school district to plan and budget,” Gardner said. That problem falls on the state, he added. “The challenge is to provide more predictability and stability.”

State cuts have hurt other local budgets, to varying extents, he added. Strickland flat-funded the local government fund but made major state cuts in almost every other priority – mental health programs, need-based financial aid for college students, public libraries and public television, Gardner said. Ohio also led the nation in early childhood education cuts.

On top of that, Governor Strickland increased taxes by more than $800 million and took $1 billion from the state’s rainy day fund to try to balance the budget.

“Being governor was hard in that recession,” Gardner said.

However, Strickland’s cuts left fewer options for balancing the state budget when Kasich took over, Gardner said. The rainy day fund was depleted and the federal stimulus money was all used up.

“With a looming state budget deficit of between $6.8 billion and $8 billion, Governor Kasich decided raising taxes would hurt Ohio’s economy and impact our economic recovery,” Gardner said. “And Governor Kasich determined that he could not make the kinds of cuts Governor Strickland made to so many programs.”

So, local government funds were slashed. Some of those funds have been restored since 2012. Beginning with the state budget passed in 2013, library funding has increased by $60 million, state aid to local schools has gone up significantly, support for higher education has increased with new financial aid grants for college students, mental health and drug addiction funding has been enhanced and early childhood education is a priority, the state senator said. Money for the arts and public television, slashed under Strickland, has been increased or largely restored.

Municipalities have been able to recover with their larger tax bases, but townships are still hurting from the cuts. “They don’t have ability to grow back income,” Gardner said.