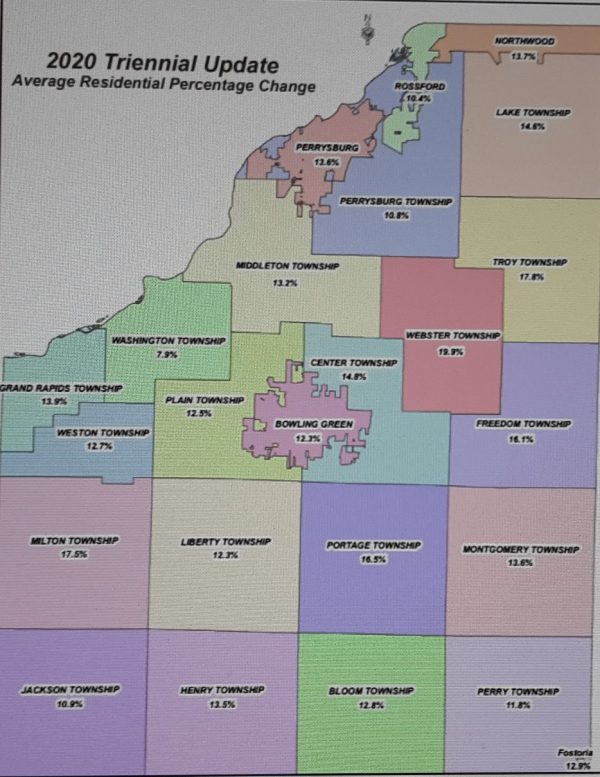

Wood County Auditor Matthew Oestreich announced today that the 2020 Triennial Update values have received state approval. Countywide residential properties have received an average increase of 13%.

Ohio law requires that each county in the state conducts a reappraisal every six years. Generally in every third year following a revaluation a “triennial update” of values by neighborhood is mandated to better reflect the current market conditions. Wood County conducted a countywide reappraisal in 2017 and is required to update the values for the 2020 tax year.

Oestreich said it is important to remember that property value adjustments are reviewed by neighborhood, so one parcel may increase more or less than the average due to location, desirability, and condition. An increase in value does not necessarily compute to a comparable increase in tax.

Ohio legislation ensures that approximately the same amount is collected each year for the voted millage. Therefore, levy millage rates will be factored up or down by the Department of Taxation so that the total amount collected will remain consistent with the amount originally voted.

“This is an important concept to understand because the reappraisal law is designed to equalize all values among taxpayers, not to enhance revenue for the taxing authorities. In other words, this is not a means of raising taxes or lowering taxes; it’s a rebalancing of the tax value burden among individual properties and classes,” Oestreich stressed.

Sales data from 2017, 2018, and 2019 were used to complete the 2020 Triennial Update. The increase in Wood County values represent a continuing trend of increasing sale prices since 2011.

“Wood County is a desirable place to live and prospective buyers are willing to pay higher prices in return for high-quality schools, lower taxes, and rural living,” Oestreich stated. He also added, “The real estate market in Wood County has been very robust for the past several years. It’s certainly been a seller’s market. Homes are selling quickly, frequently with multiple offers, and oftentimes at or above the list price.”

The trend of increasing prices has continued in 2020 despite the COVID-19 pandemic.

Fewer homes are selling in 2020, but median prices continue to increase. The Toledo Board of Realtors report in their Wood County July Housing Statistic Update that the median sales price in July 2020 was 15.9% higher than July 2019.

An estimation of tax cannot be determined at this time due to the above mentioned tax reduction factors and tax levies that are currently on the November 2020 ballot. The Department of Taxation does not release factored tax rates until county election results have been certified and until the certification of values is completed for taxing authorities that overlap adjoining counties.

In addition to an increase in residential property values, an average zero change was seen in industrial and commercial property throughout the county. The county will see a decrease in agricultural land valuation for all properties enrolled in the CAUV tax savings program. The CAUV soil values are determined by the Ohio Department of Taxation and updated in conjunction with the county’s reappraisal cycle. Not all Ohio counties are scheduled for reappraisal in the same year.

Beginning Sept. 28, property owners may review their property valuation during the open inspection period. The new 2020 value will be available on the auditor’s real estate website at http://auditor.co.wood.oh.us .

Property searches can be done using owner name, address, or parcel number. Once the property is found and selected, the previous tax value and new tax value will be shown in the valuation section. Property owners are encouraged to review all of the property characteristics to ensure accuracy.

Property owners may also review their property value in person in the auditor’s office on the second floor of the county office building between the hours of 8:30 to 4:30 weekdays or by calling the office at 419-354-9173 or toll free 1-866-860-4140 ext. 9173.