By DAVID DUPONT

BG Independent News

When it comes to deciding whether to install solar panels on the farm, it’s more complicated that just letting the sun shine in.

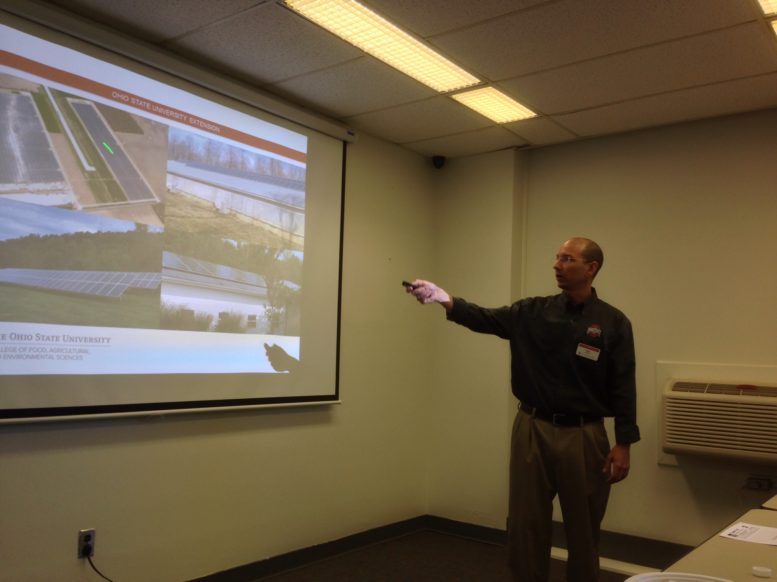

Eric Romich, a field specialist in energy development for the Ohio State University Extension Service, had to go deep in the weeds to answer the simple question: What’s the payback? He addressed that question Thursday at the Northwest Ohio Ag-Business Breakfast Forum.

It all depends, he said. It depends on energy needs and regulations, and, yes, politics. Depends certainly on what the solar installer says. It also depends on what the utility representative says, and what the farmer’s accountant and, maybe, the attorney, have to say.

“This works,” Romich said. “I’ve known a lot of farmers that have installed (solar panels) and they’re happy with them.”

Those who were happy, he said, were those who viewed them as long-term investment, 30 years or so. Those who expected a quick financial return on the investment were not satisfied.

In 2008, more than 11,000 farms had solar installations. Just four years later that was up to 34,000.

Still despite the increase in solar production, Romich said, “it’s still a drop in the bucket” when it comes to total electricity production.

Farmers considering adding solar have a lot to consider. Every farm and installation is unique, Romich said. While farmers should consider multiple proposals, evaluating those can be difficult.

The cost should be considered independent of federal incentives, including grants and low-interest loans. Only a third of applications secure that kind of funding. And the grant can be considered taxable income.

They need to make sure that the estimate includes cost of operating, maintenance and insurance. True, solar collectors are relatively simple and typically have warranties, but anything that’s around for 20 years is probably going to need maintenance.

These projects can generate solar energy credits that in turn can be sold through brokers to utilities that need to meet state threshold of renewable energy. But the price of the credits “has really taken a dive.”

For one thing, more solar power is being produced. Just like with corn, greater supply leads to lower prices.

Also, in 2008, Ohio enacted the 25 by ’25 standard that called for 25 percent of the state’s energy to be produced by alternative or advanced sources by 2025. Then in 2014, those goals were frozen for three years. Once that freeze was put in place the rate for credits have decreased. Now new legislation introduced in the state senate would freeze them for another three years.

“Policy is fluid,” Romich said. “Policy impacts payback.”

No installation should be made with the assumption that policy will be the same even in five years.

“To get full value” from the energy produced, Romich said, “you need to use it.” Then the farmer has to buy less from the utility.

The question also arises about where to put the solar array. Often farmers look at existing buildings and want to place a solar panels there.

That may not be the right place, since the angle toward the sun at various seasons changes how much electricity is generated, Romich said. Ground-based systems, sited for maximum exposure, tend to produce more electricity.

Systems that track the sun are available, he said, but he’s not seen many installed.

Dan Klear, of Superior Energy Solutions, said, after the talk, that those systems have more moving parts and therefore need more maintenance.

He also cautioned against assuming a barn or pig shed could necessarily hold the weight of solar panels. He was working on a newer non-farm building, recently, and brought in structural engineers to assess how much weight the building could bear.

He’s also found that with the price of corn going down, the market for solar installations on farms has also declined.