‘Coalition to Regulate Marijuana Like Alcohol’ wins out at Ballot Board

BY: JAKE ZUCKERMAN

Ohio Capital Journal

A state board gave the green light for organizers to begin gathering tens of thousands of signatures to inch closer to legalizing the sale of marijuana for recreational use in Ohio.

Should they gather the roughly 133,000 signatures needed, the so-called “Coalition to Regulate Marijuana Like Alcohol” organizers would give their proposal to the Ohio General Assembly. Lawmakers would then have four months to act on the proposed law legalizing marijuana use for those 21 and up.

On Monday, the Ohio Ballot Board unanimously agreed the proposal only spans a single-issue, the final regulatory hurdle before signatures can be amassed.

Thomas Haren, a spokesman for the coalition and Cleveland attorney who practices cannabis law, said he and other organizers are “laser focused” on getting the initiative through the Statehouse in lieu of a ballot referendum.

“The name really says it all,” he said. “We want to regulate marijuana like alcohol. By that, we mean restrict sales to people under 21 years of age. We want to make sure every product is tested, it’s produced here in Ohio by licensed cultivators or processors, [and] sold at licensed dispensaries.”

The coalition is trying to legalize marijuana by a process called an “initiated statute” in which they gather enough signatures to force lawmakers to consider their proposal. If lawmakers fail to act for four months after the signatures are submitted, the coalition could then move to place the initiative on the ballot for the 2022 election.

Under the proposal, marijuana would be taxed at 10% at the point of the sale. Proceeds would be split between fighting substance abuse (25%); a community host fund for localities with dispensaries (36%); the “cannabis social equity and jobs program,” aimed to remedy harms resulting from the “disproportionate enforcement of marijuana related laws;” and paying program costs (3%).

The idea can be lucrative for the state. Colorado, roughly half the population of Ohio, levies a 15% sales tax on retail marijuana, plus a 2.9% sales tax on marijuana sold in stores and a 15% wholesale sales tax. The state earned $387 million in marijuana tax revenue from calendar year 2020, according to state data. Michigan, which launched its recreational program in late 2019, received $45.7 million in tax revenue in fiscal year 2020.

Research from Ohio State University’s Drug Enforcement and Policy Center within its law school estimated that Ohio could drive $625 million in revenue from recreational marijuana sales, assuming the state taxes and its residents consume marijuana at even levels as Colorado.

Under the proposal, adults would be able to grow up to six plants (maximum of 12 per household). Local governments could vote to limit the number of cannabis operators within their borders but cannot prohibit existing medical marijuana businesses.

Haren said a program could launch as soon as nine months after the effective date of the new law.

“It’s time for Ohio to take the next step. We think this is something Ohioans support and are in favor of,” he said. “We think it’s wildly popular among the voting public.”

Ohio law is comparatively lax on marijuana. People convicted of possessing less than 100 grams are guilty of a minor misdemeanor — no jail time and a maximum fine of $150. However, courts can still choose to suspend the driver’s license of those convicted for anywhere between 6 months and five years, according to the OSU research.

Eighteen states, plus Washington D.C., have legalized marijuana for adult recreational use, according to July research from the National Conference of State Legislatures. Thirty-six, including Ohio, have legalized marijuana for medicinal use.

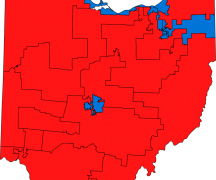

Twelve Democrats in the state House of Representatives have signed onto separate legislation — sponsored by Reps. Casey Weinstein and Terrence Upchurch — that would legalize the sale of recreational marijuana. No Republicans have signed onto the proposal.

***

Also from Ohio Capital Journal:

Ohio to hire 200 customer service workers to tackle unemployment claims

The Ohio Controlling Board on Monday approved more than $11 million so the state Department of Jobs and Family Services can contract with a D.C. company for customer service representatives.

The company, Conduent State & Local Solutions, Inc., would provide “up to 200 tier 1 agents to answer calls from claimants on their unemployment insurance applications and benefits,” according to the request made to the controlling board.

At the board’s Monday meeting, the request was discussed by Bryan Stout, legislative liaison for ODJFS. He said Tier 1 agents are the first level of contact for those in the unemployment process, and can answer basic questions like how to reset passwords, and direct callers to Tier 2 and Tier 3 employees, who answer more intensive questions about the system.

“One of the challenges that we continue to deal with and face…is that it’s not just being able to get someone to pick up the phone and say ‘hello,’ but getting someone to have that one-call resolution,” Stout said. READ MORE

How information likely leading to massive settlement almost stayed hidden

t seems to be an object lesson in the importance of government transparency.

Revelations that quite possibly led to a lawsuit and a billion-dollar settlement by the nation’s largest Medicaid managed-care provider almost never came to light, according to court documents filed last month.

Meanwhile, huge drug middlemen are fighting to keep sealed damning information that’s already been reported in the press.

After languishing for more than three years, a lawsuit filed by the fourth- and fifth-largest corporations in the country against the Ohio Department of Medicaid is scheduled to finally go to trial in the Franklin County Court of Common Pleas on Sept. 9.

It pits pharmacy benefit managers owned by CVS Health and United Health Group against the state as they fight to protect what they regard as trade secrets and what the state’s lawyers say is public information regarding huge sums of taxpayer dollars. READ MORE