By JAN LARSON McLAUGHLIN

BG Independent News

The Bowling Green school bond issue was already a tough sell in the farming community. It won’t be any easier now that local farmers are struggling to just get their fields planted this year due to the abnormal amount of rain.

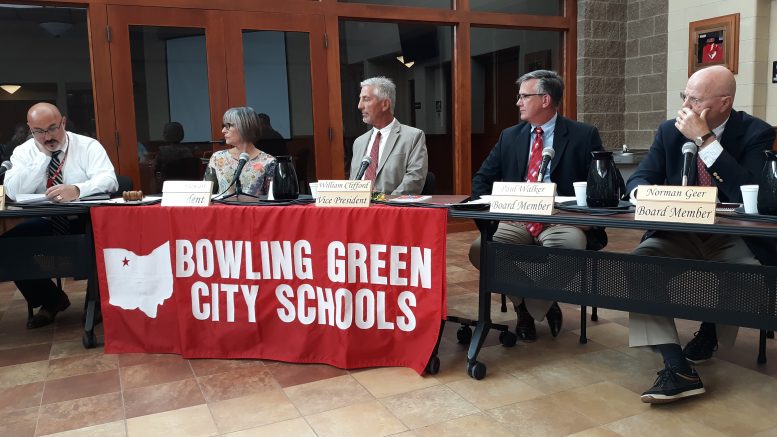

On Tuesday evening, the board of education heard concerns that the $40 million property tax/income tax issue for a new elementary building on the ballot this November will face an even tougher challenge this time around.

“There’s a pretty big hardship out there in the county with the flooding we’ve had the last five months,” board member Paul Walker said.

Grant Chamberlain cautioned the school board that the inability to get crops in the fields will make farmers even less likely to vote for more taxes.

“It’s really put the agricultural market in a bad spot,” Chamberlain said. “Most of the crops in this county haven’t been planted yet, and they won’t be planted.”

The impact won’t stop there, he said, predicting higher costs will be seen in grocery stores and at gas pumps. “It’s going to hit everyone.”

Chamberlain warned the building issue on the ballot won’t be viewed kindly by the agricultural community.

“This may be a nasty fight for you guys,” he said to the board. “Good luck.”

But some relief is possible, according to David Conley, the school district’s financial consultant with Rockmill Financial.

Conley told the board that the collection of property taxes can be deferred for three years. So if the issue passed this fall, the property tax collection could start in 2022 or 2023. There is no such flexibility with the income tax portion of the building issue – which was added to the bond funding formula in order to make the issue easier on the farming community.

“At least the property tax side we can defer,” Conley said.

At Tuesday’s meeting, the school board agreed to only put the building issue on the ballot this fall. Another option was to try another issue – merging a 4.2 mill operating levy and a $1 million emergency levy into one combined issue – and converting that into a continuing issue.

Board President Ginny Stewart asked for Conley’s input on putting that issue on the fall ballot or waiting until next spring.

Conley suggested the board delay the combined issues until March, which will give the district more time to explain why the levies are being combined and turned into continuing issues. The benefits would be to limit the number of times the board has to go back to the voters for the same money, it preserves the rollback of the original tax issues, and it means the district could operate with a lower carryover since the funding would be continuing.

“There is a learning curve,” Conley said of the merged issues. And trying those at the same time as the building issue would be risky.

“That could pose a challenge for people in the community who haven’t been following this,” he said.

The disadvantage, Conley said, is that waiting until March of next year only gives the district one more shot in the fall of next year if it fails the first time around. The renewals, which expire at the end of 2020, are “critical to the operation of the district,” he said.

Board members agreed to delay the combined issues till next spring.

“Preserving the homestead (rollback) is probably our priority,” Walker said.

And the district may need time to get the word out.

“I prefer deferring till 2020,” giving more time for voter education efforts, board member Bill Clifford said. “We don’t want to combine it with a critical building issue.”

Board member Norm Geer agreed.

“I think we should concentrate our efforts on the elementaries” this fall, Geer said.

Stewart concurred.

“I agree, we’ve got enough on the ballot right now.”

Citizen Ken Rieman supported the board’s decision to combine the two issues and convert it to a continuing issue. That move will preserve the homestead, help the district’s balance, and decrease the number of times the board goes on the ballot.

“What’s not to like about it,” Rieman said. “It looks like a good business approach that provides some stability.”