By JAN LARSON McLAUGHLIN

BG Independent News

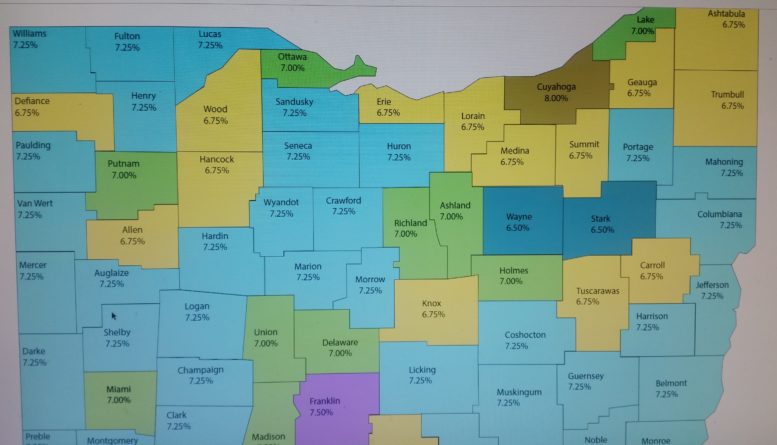

Wood County is on an island of low sales tax in this region – and officials have no intention of moving from its haven for penny-pinching shoppers.

The county is surrounded by neighboring counties with higher sales tax rates, except for Hancock County, which is the same as Wood County.

Some officials suspect that at least some shoppers are lured into Wood County because of the lower sales tax.

“It’s probably not the first thought in their mind,” but on bigger purchases it could encourage shoppers to cross county lines, Wood County Administrator Andrew Kalmar said. The sales tax on a $1,000 refrigerator in Lucas County would be $72.5, compared to $67.5 in Wood County.

“We’re like an island,” Kalmar said. “Everybody around us has a higher sales tax,” except Hancock County.

In the recent general election, Hancock County voters had the chance to raise their sales tax there by 0.25 percent. The increase was soundly rejected, so that county will remain at the same low rate as Wood.

Meanwhile most surrounding counties are 7.25 percent, including Lucas, Fulton, Henry, Sandusky and Seneca.

The state takes the first 5.75 percent in sales tax revenue, then counties can raise sales tax up to an additional 2 percent. Counties and transit authorities are the only entities that can collect sales tax. The highest sales tax in the state is in Cuyahoga County at 8 percent, and Franklin County at 7.5 percent.

Sales tax is a pretty solid revenue for Wood County. Last year, shoppers paid close to $21 million in sales tax. The receipts are even better this year, coming in at $1.8 million this October – a 13 percent increase over the $1.6 million brought in last October.

“It’s a pretty decent amount of money,” Kalmar said.

Wood County has benefited from a boom in retail growth, primarily in the Perrysburg and Rossford areas. Many stores that local residents previously had to go to Lucas County to patronize, can now be found on this side of the Maumee River.

“Wood County is in a fortunate position because of retail growth in the county,” Kalmar said.

Following is a list of sales tax percentages in Ohio:

- 8 percent – 1 county, Cuyahoga

- 7.5 percent – 1 county, Franklin

- 7.25 percent – 51 counties

- 7 percent – 13 counties

- 6.75 percent – 19 counties

- 6.5 percent – 3 counties, Butler, Stark and Wayne

Because of the growth in retail, Wood County is seeing an increase in sales tax revenue without increasing the sales tax rate.

That additional sales tax revenue is being eyed by the Wood County commissioners as a way to make up for at least a portion of the county’s loss in Medicaid sales tax.

Since 2010, the state of Ohio and its counties have been collecting sales tax from Medicaid Managed Care organizations, which provide medical services and equipment. Those sales taxes brought in about $597 million a year for Ohio and other $200 million for counties.

But in 2014, the federal government decided that collecting the Medicaid sale tax was not proper. Ohio was told it either had to apply the sales tax to all managed care – not just those serving Medicaid clients – or to none. The feds also objected to the fact that since the U.S. government pays at least 60 percent of Ohio Medicaid costs, it was basically paying an indirect federal subsidy to Ohio.

Gov. John Kasich asked and received a waiver on the sales tax that will make the state whole. In fact, the state may bring in a bit more – $615 million a year. The problem is, Kasich failed to include counties in on the waiver.

The governor’s budget will reimburse counties a portion of the sales tax revenue for one year – but then counties are on their own.

“It only corrected the state’s problem,” Kalmar said. “It leaves the counties out.”

So as it stands now, Wood County will be out $900,000 a year. That’s 3 percent of the county’s general fund of approximately $41 million.

The pain will be even greater for bigger counties, Kalmar said, noting that Lucas County stands to lose up to $11 million a year.

The Wood County Commissioners believe they have endured enough funding cuts from the state and economic factors. Those include cuts to the local government fund, elimination of personal property tax, a severe economic recession, an interest rate that remains near zero, and reductions in property tax valuations.

So the general sales tax revenue increase may be a partial salvation for the loss of the Medicaid sales tax.

“Wood County has had a significant amount of retail growth over the last 10 years,” Kalmar said. “That has helped us tremendously make up for losses.”

But county officials have no plans to try for more revenue by increasing the sales tax – they rather like being an island, Kalmar said.