By JAN LARSON McLAUGHLIN

BG Independent News

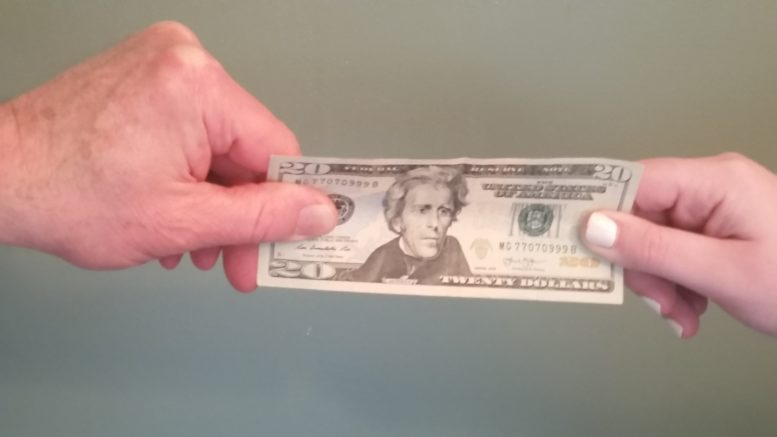

As Ohio Gov. John Kasich boasts about digging the state out of a deficit and cutting taxes, local government officials see little to brag about. To them, the state’s strategy was not tax cuts, but “tax shifts,” putting the burden onto municipal, township and county governments.

The changes in tax revenue have affected every community in Wood County. On the larger side, Bowling Green has lost $964,764 in annual income, and Perrysburg has lost even more at $1,154,451. On the smaller side, Pemberville lost $43,924 a year, Weston lost $41,335, and Haskins lost $5,368, according to the Ohio Department of Taxation.

“This is putting the pressure on communities to raise those taxes,” said Kent Scarrett, director of communications for the Ohio Municipal League.

“The state says we are cutting taxes left and right,” Scarrett said. “The fact is, that burden is put on local communities.”

The three changes made by the state are:

- Elimination of Ohio estate tax, which is also called the “death tax.” Eighty percent of this money had gone to local communities. Bowling Green lost an estimated $382,848 a year.

- Big cuts in the state’s Local Government Fund, which made up sizeable portions of county, municipal and township budgets. The LGF was created during the Depression when the sales tax was enacted to share money with grassroots government. Bowling Green lost $563,480 a year.

- Elimination of local property taxes on business machinery and inventory, also called the CAT tax. The state had a planned phase out of the tax over a period of time, but hastened the cuts. Bowling Green lost $18,436 a year.

Those cuts have some communities struggling to keep vital services, such as fire stations open, and are considering more reductions in city services, Scarrett said.

“That’s the disconnect that’s going on,” he said. “You’re just shifting the burden.”

Across the state, communities are trying four main strategies to handle the funding cuts, according to Scarrett.

The first is natural attrition, “especially in safety areas like police and fire,” he said. “A lot of communities aren’t filling those positions.”

Next is increasing fees and service charges, for such items as trash pickup, utilities or permits.

More communities are also looking at reducing or eliminating tax credits for residents who work outside the municipality.

And finally, “the last resort many communities look for” – tax increases, Scarrett said.

The state initiated the tax changes to help deal with an $8 billion budget deficit in 2010. The state was suffering from a depressed economy and reduced revenue.

But so were local communities, Scarrett said. “For five years, our folks had already been working through this. Our folks were already trying to find reductions.”

“Our communities know that more economic activity raises revenues,” he said. But attracting economic activity is difficult for communities when their funding is cut.

Scarrett suggested that since Ohio has recovered from its deficit, and has more than $2 billion in its rainy day fund, that it’s time to start sharing the wealth with grassroots government again.

“Our communities are strapped,” he said.

Grants are not the solution, as some state leaders believe, Scarrett said. Many communities don’t have the matching funds required to secure grants. They need funding “without strings.”

“Putting more grants out there is not the answer,” he said.

Despite Kasich’s aversion to sharing tax revenue, the Ohio Municipal League is pushing for some of the funding to be restored to local governments. “The money is not going to come back immediately,” but it will help.

Bowling Green Finance Director Brian Bushong said the cuts have impacted the city. The city avoided layoffs, but “we let attrition happen,” he said. The problem with attrition though is that it doesn’t always occur where it’s needed.

The city has been helped by a healthy growth in income tax revenue, which offset the cuts. But the city is breaking even, rather than benefitting from the income tax growth.

“We would love to have more funding,” Bushong said. “I understand everybody wants that share of the pie.”

Wood County also felt the squeeze from the state. The changes in personal property tax cost the county $700,000, and the Local Government Fund cuts took away more than half of the $2.12 million a year the county was accustomed to receiving.

The county has been able to compensate somewhat with other funding, according to Wood County Administrator Andrew Kalmar. “While we’re losing money in our Local Government Fund, our sales tax is good. One goes up, one goes down.”

But at the same time, the county’s investment income dropped from $4.63 million in 2007, to $1 million in 2014. And while the county was told it would receive $2.5 million a year in casino tax revenue, the reality is just $1 million.

Kalmar said Wood County is weathering the cuts much better than some counties because of the healthy retail here that brings in sales tax revenue. Many small counties have much less opportunity to recover those lost funds, he said.

“Sales tax has done pretty well at making up for those cuts, but that’s in Wood County,” Kalmar said.

The Ohio Municipal League is pushing for some return of the shifted taxes. Scarrett said some state legislators understand the pressures being placed on their communities and the value of investing in their local governments.

“They hear from their communities,” he said.

Though some have turned a deaf ear to those concerns, Scarrett said the legislators representing Wood County – State Sen. Randy Gardner and State Rep. Tim Brown, both Republicans from Bowling Green – are supportive of shifting back funds. They get it, he said.

“They are two fantastic legislators to work with,” Scarrett said. “They have tried to move the needle. They’ve been very supportive of their communities. They absolutely get the problem.”