By JAN LARSON McLAUGHLIN

BG Independent News

Talk of raising taxes normally raises the dander of local taxpayers.

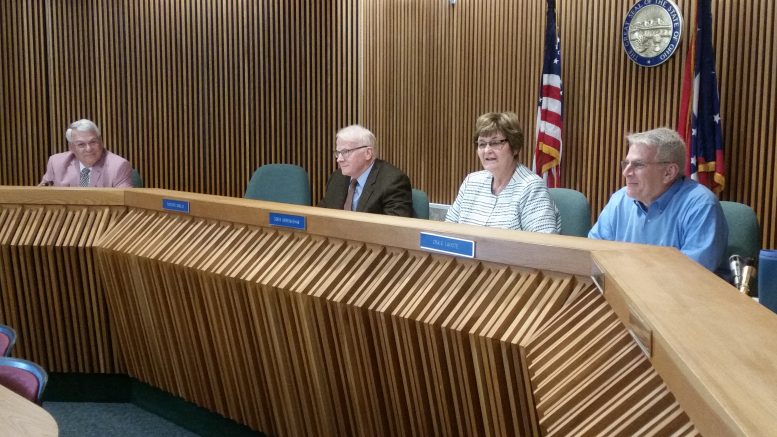

But when the Wood County Commissioners held a public hearing Thursday morning on a proposed $5 license tax, no one showed up to complain. The commissioners took that as a sign that local residents realize the poor condition of county roads and bridges.

The public will have one more chance to voice opinions during the second public hearing on the tax set for May 17, at 10 a.m., in the county commissioners’ hearing room.

The new tax was requested by Wood County Engineer John Musteric, who is tired of just spinning his wheels on endless road and bridge repairs. The $5 permissive vehicle license tax will be used only for road and bridge expenses, Musteric said.

“Every little bit helps,” he said on Thursday.

According to local county officials, state and federal government have no appetite for raising gas taxes themselves. And the revenue brought in by gas taxes isn’t growing to meet expenses, since more fuel-efficient cars mean less gas is needed to traverse the state.

But the state has given local governments the option of tacking on the new tax.

“They recognized the stagnant funding of local transportation systems and that counties were struggling to keep up with the need for bridge replacements and road repair,” Musteric said.

The proposed $5 increase is projected to bring in an additional $632,660 annually for road and bridge repairs. Musteric pledged to the commissioners that the additional funds would be used only on capital expenses, not on personnel or operating costs.

Currently the state registration fee is $34.50, and the local permissive fees are between $15 and $20, depending on the community.

The federal gas tax of 18.4 cents has not been increased since 1993, and the state gas tax of 28 cents has not been increased since 2005.

“Our revenues have been stagnant,” Musteric said.

Meanwhile, the cost of building and maintaining roads has continued to grow. Since the last state gas tax increase, the cost of asphalt has jumped 58 percent, steel has increased 35 percent, concrete has gone up 10 percent, and road paint has jumped 38 percent.

“So we have to do something,” Musteric said Thursday.

To deal with stagnant or declining revenue plus rising costs, some counties have enacted county road and bridge levies. Wood County has not. Some counties have dedicated a portion of their sales tax revenue for roads and bridges. Wood County has not.

According to Musteric, the county engineer’s office has tried to do more with less. The office has reduced the number of employees from 52 in 2006 to 44 in 2018. He is also trying to turn over some of the smaller roads to township maintenance, and transfer bridges inside municipalities to their care.

The operating budget for the engineer’s office has barely budged since 2006 when it was $7.6 million, to 2017 when it was $7.75 million.

Musteric said the county is in an impossible position of catching up on road and bridge repairs. Following are some statistics about county bridges:

- County owns and maintains 441 bridges.

- Average age of the bridges is 41 years old.

- Bridges 50 years old or more: 149.

- Bridges 75 years old or more: 68.

- Bridges 100 years old or more: 21.

- Bridges in poor or worse shape: 52.

- Oldest bridge in county: 133 years old.

Bridge repairs and replacements don’t come cheap. The average bridge replacement costs $400,000. The cost to replace all the county’s bridges in poor or worse condition is estimated at $20.8 million.

The average number of bridges replaced in one year is four and a half. To keep up with maintenance, the county should be replacing nine a year, Musteric said.

The status of county roads isn’t much better, with 74 percent rated in marginal or worse condition.

- County has 245 miles of roads it must maintain.

- Rated as “good” are 12 miles of roadway.

- Rated “fair” are 52 miles.

- Rated “marginal” are 64 miles.

- Rated “poor” are 79 miles.

- Rated “serious” are 38 miles.

“We need to work on those,” Musteric said.

The estimated cost to bring all county roads to at least “fair” condition is $39 million. Repairing a mile of road can be costly. A mile of chip seal is $15,000; and mile of microsurfacing is $40,000; and a mile of hot mix asphalt is $85,000.

To keep up with road repairs, the engineer’s office should be spending about $2.3 million a year. But the office is budgeting $1.1 million a year.

The engineer’s office revenue comes from state and federal gas tax ($2.4 million a year), license plate fees ($4.3 million a year), fines from highway offenses ($168,000 a year), and county gas tax ($800,000 a year).