By JAN LARSON McLAUGHLIN

BG Independent News

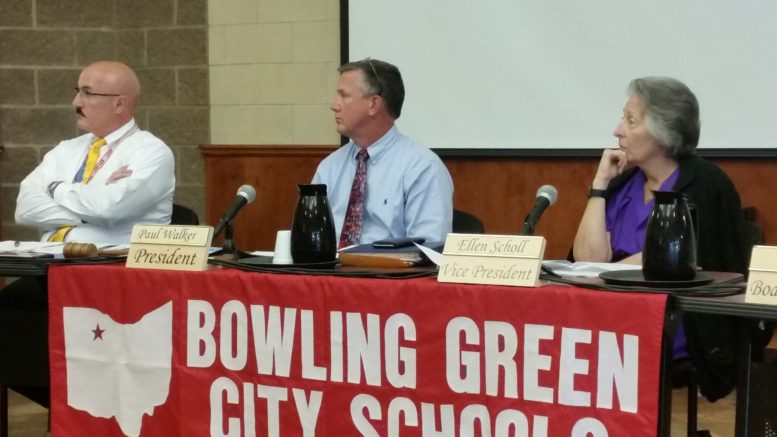

In May, when Bowling Green School District Treasurer Rhonda Melchi showed the school board the five-year financial forecast for the district, the budget looked like a rollercoaster. Last week, when Melchi revisited the forecast, it looked more like a game of hide-and-seek – in a heavy fog.

But one item was certain – the school district will need to renew its 0.5 percent income tax next year.

After that, the forecast gets a little blurry again, but by 2020 the district could be $4 million in the hole unless something changes.

“We will need some new revenue sources,” Melchi told the school board. “I’m very conservative. I don’t like to give you a best scenario.”

The income tax for the district began in January of 1993 and has been renewed every five years since. It makes up 11 percent of the district’s general fund revenue. “That’s pretty significant,” she said.

To place a renewal on the May 2017 ballot, school board members will need to take action at their December meeting. At that point, they will have to decide whether to stick with a five-year tax or ask for a continuing tax.

Melchi predicted the district would receive an overall increase in foundation funding from the state. “We do expect to see a little more of an increase over last year,” she said.

But doing accurate five-year planning is very difficult for the district, she added. “We really don’t know what’s going to happen.”

The cost of supplementing charter schools continues to affect the district. Melchi explained that the state gives Bowling Green $1,907 per student each year. But for every student who chooses to leave Bowling Green for a charter school, the state takes $6,000 from the district to give to the charter school.

Expenses are also up, with the district adding 12.35 staff positions due to increasing enrollment and a growing special needs population.

“There have been factors that have forced us to make those decisions,” Superintendent Francis Scruci said.

The annual budget is also greatly affected by the number of paydays each year. This year has 27, compared to 25 last year, which makes a big difference, Melchi said. That and the phase out of tangible personal property taxes will result in a revenue stream down by $1 million next year, she added.

“That’s a big hit,” Melchi said.

In other business at last week’s board meeting, fall athletes from boys cross country, and boys and girls golf were recognized for their winning seasons.

The board also approved of trips for the Model United Nations organization to travel to Chicago, and the DECA group to travel to Cleveland.