By DAVID DUPONT

BG Independent News

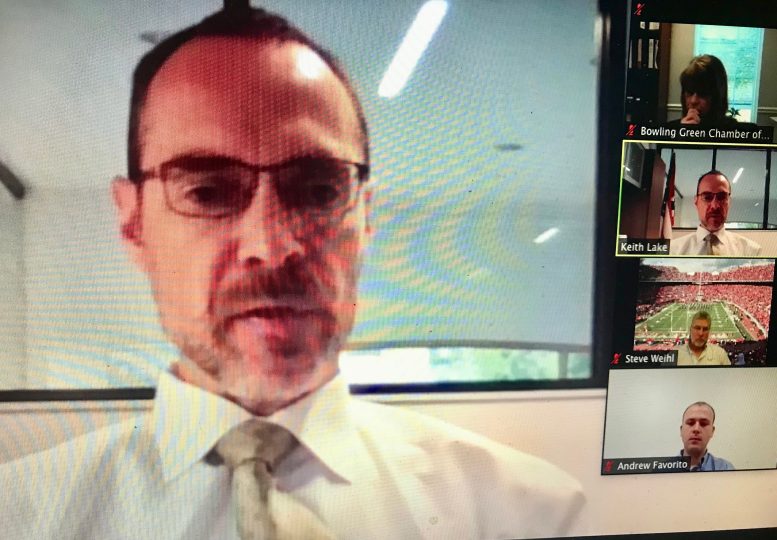

Keith Lake, the Ohio Chamber of Commerce’s vice president for governmental affairs, was happy to be talking about the challenges of getting employees back to work and helping them get vaccinations.

A year ago the concern was about the pandemic and the health orders, government rules, and severely constricted cash flow that came with it.

The Bowling Green Chamber of Commerce’s legislative update was still being held virtually – there was still uncertainty about what would be allowed when it was scheduled Mary Hinkelman, executive director of the chamber said.

Still the shift in topics for this annual update from Columbus was welcomed. “It’s a good sign we’re beginning to have those kind of conversations,” Lake said. “Our economy is picking up steam.”

Employment related concerns were a big part of the conversation.

The inability to find workers to hire is the number one problem for members, Lake said. Many of them are finding the $300 additional federal unemployment payment is hindering their efforts to find people to fill open positions.

The chamber ran the numbers and found that someone making $20 an hour is just breaking even to what they would collect on unemployment. A lower hourly wage means they are losing money. “It’s clearly a deterrent.”

That federal unemployment benefit lasts through September, Lake said. The state is not required to take it. And there is now talk about Ohio terminating it.

Andrew Favorito of Home2 Suites by Hilton said the company doesn’t need more federal dollars, it needs employees.

Steve Weihl, of Ag Credit, said that’s affecting farmers as well because they are finding it hard to buy replacement parts because the manufacturers are having difficulty finding help. Suppliers are complaining that they can’t find truck drivers and warehouse workers.

That problem creates backups throughout the supply chain, Lake said.

There were workforce problems before the pandemic hit, he said, and it’s worse now.

He said there are 160,000-170,000 jobs available throughout the state.

Mary DeWitt, of OhioMeansJobs, said employers still call her office to post jobs paying $12 an hour. “That’s not going to cut it anymore,” she tells them.

They need to raise those to $15 to $16, and even that may not be enough. There’s “the benefits cliff” to consider. When someone earns a certain amount, they lose SNAP and child care benefits.

People tell her that “if you’re not making $20 you’re not self-sufficient.”

Lake also addressed the long-standing problems with the state’s unemployment insurance trust fund that “has been bumping along close to insolvency for 20 years now.”

During the recession back in 2009, Ohio had to borrow money from the federal government to cover the cost of benefits. That loan was repaid by employers. In the intervening years, a balance of $1.2 billion was built up. That was gone quickly when the pandemic drove the unemployment rate up 20 percent. The state borrowed another $1.5 billion from the feds, and the state’s employers will be on the hook for that unless something is done, Lake said.

The Ohio Chamber would like the state to use some of $5.5 billion in federal aid coming its way from the feds to cover that debt. Gov. Mike DeWine seems to be agreeable to that.

In terms of a long -term fix, Lake said, the chamber has been pushing the legislature for that since before he was hired nine years ago.

The answer to that problem is simple, but not easy, Lake said. “It’s a closed system.”

The only source of revenue is the state unemployment tax paid by employers, and

“the only place those dollars go is to unemployed Ohioans who lose their jobs through no fault of their own.”

To come up with a solvent system that “doesn’t go broke all the time,” the system either has to bring in more money, pay out less, or a combination of the two. “But it’s not easy because the more money coming in means you’re raising taxes on the employers in the state of Ohio, and a lot of lawmakers not interested in raising taxes,” he said.

“We have been pushing them to do a balanced package that does both, provide more revenue for the system and reduces benefits to some degree,” he said. “That’s a very, very difficult political problem that there’s not the political will to solve at this point.”