Ohio took a step closer toward a constitutional school funding model with the passage Wednesday of a two-year operating budget in the Ohio House of Representatives, a sweeping bill that also proposes an across-the-board income tax cut, a broadband internet expansion plan and more spending to aid businesses struggling from the pandemic.

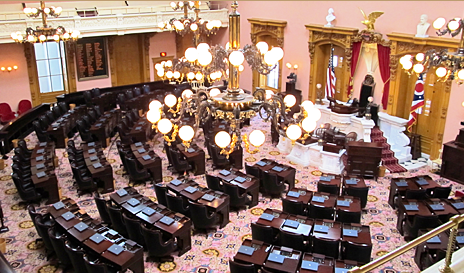

The House passed a two-year, $74.4 billion budget for Fiscal Years 2022 and 2023 by a vote of 70 to 27.

Democrats took issue with certain portions of the budget, but its education funding reforms helped lead a dozen of them to ultimately join the Republican majority in approving the bill.

The budget now heads to the Ohio Senate, which will negotiate its own version over the coming months. Members of both legislative chambers will eventually hash out disagreements before a final version is sent to Gov. Mike DeWine for approval this summer.

“We are investing in Ohio’s priorities and Ohio’s future,” said Rep. Scott Oeslager, R-North Canton, who serves as the House budget chairman as he has for several previous budget cycles.

Oeslager said the ongoing pandemic has presented a wide array of challenges for Ohio, and the ongoing needs associated with the crisis are evident. He complimented House members for crafting a “balanced, responsible and truly meaningful” budget.

This budget does not include any federal spending from the American Rescue Plan. Speaker Bob Cupp, R-Lima, said Ohio has not yet received this relief funding and a forthcoming committee would determine how best to spend it.

Here are budget highlights as approved by the Ohio House of Representatives.

Education funding model overhaul

It has been more than 24 years since the DeRolph v. State decision was handed down by the Ohio Supreme Court, which ruled Ohio’s state funding model does not provide an equal opportunity for all students to learn and is therefore unconstitutional.

Lawmakers were tasked with determining a more equitable, constitutional funding model — something they have failed to accomplish in the decades since.

Cupp has led a renewed push to reform the funding system in recent years and said after Wednesday’s vote he was glad this budget achieves that goal.

The House-approved budget includes a nearly $2 billion increase in school funding, with most districts expected to receive more funding over the next six years. (A spreadsheet showing the funding estimates for each individual district in Ohio was published by The Columbus Dispatch.)

Cupp said he did not want to speculate on potential disagreements the Senate may have with this funding plan, but hoped there would be more productive conversations between members of the two chambers on this subject.

“We think they will agree that it is a very good plan going forward,” he said.

Detailed Ohio Capital Journal reporting on the education reforms included in this budget is forthcoming.

More spending for COVID-19 relief; vacating penalties for health violations

The budget includes relief spending to benefit a variety of Ohio businesses.

Millions of dollars would go toward helping entertainment venues, bars, restaurants and hotels. Additionally, there is a “New Business Relief Grant” program to specifically help those businesses that opened after Jan. 1, 2020.

Republicans also inserted a budget provision that would vacate all public health violations incurred by Ohio businesses since March 2020.

Businesses that have faced penalties for violating public health orders, such as not enforcing mask and distancing mandates, would have their violation records expunged. Any disciplinary actions currently in progress would be halted.

The state would be forced to repay any fines levied and reinstate licenses revoked. The Legislative Service Commission (LSC) estimates this would amount to $100,000 in fines repaid to health order offenders.

This provision mirrors a separate bill introduced by Republicans earlier this year.

Cupp defended this provision by saying Ohio businesses failed to abide by public health orders because the virus was an “unknown” phenomenon in 2020.

“The restrictions were new, they were different, and a lot of businesses sort of got caught up in this administrative web. As we work our way out of the pandemic, we think it’s important to take another look at (the violations) and to give them some sort of the benefit of the doubt…,” Cupp said.

Tax cuts

Another main portion of the bill involves income tax cuts and deductions.

There is a 2% personal income tax cut for all earners, which LSC estimates would save taxpayers around $380 million in the coming two years.

“Once more, the wealthy and big businesses will fare far better than working families under this budget,” said Rep. Michael Skindell, D-Lakewood, who unsuccessfully proposed taking out the tax cut and diverting it to other priorities.

He cited data from the Institute on Taxation & Economic Policy, which was promoted by the think tank Policy Matters Ohio, which shows the tax cut would primarily benefit the richest Ohioans.

Those earning under $40,000 per year would receive virtually no benefit from this tax cut, the study found. Ohioans earning between $40,000-61,000 per year would see their taxes cut by an average of $7 over the course of an entire year.

The top 1% of Ohio earners, those making more than $490,000 per year, would comparatively see their taxes cut by an average of $612 each year.

Skindell said the tax cut shows a “huge disparity and continues the tax shift in this state.”

Separately, the House budget institutes an income tax deduction on capital gains earnings for Ohio-based “venture capital operating companies.” Such investors could deduct all of their earnings from investments in Ohio businesses and 50% of earnings from investments in businesses elsewhere.

LSC estimated this provision may cost the state tens of millions of dollars per year in income tax revenue lost.

Broadband internet expansion

Ohio lawmakers have worked toward a bipartisan effort this year of expanding broadband internet access in the state.

With several bills already progressing toward that end, lawmakers opted to include the proposed “Ohio Residential Broadband Expansion Grant Program” in this budget.

The budget allocates $190 million over the next two years toward grants to pay for new broadband expansion infrastructure projects.

Other pieces of the budget

Here are some other noteworthy provisions from the budget bill:

- The governor had proposed changing antiquated language in Ohio law to clearly state all couples can adopt children (LGBTQ couples are legally allowed to in Ohio). The governor suggested changing the phrase “husband and wife” to read “legally married couple,” but Republican lawmakers took out this change to leave the original language in place.

- The budget allocates millions of dollars for firefighting equipment and training, along with millions more for a law enforcement training program.

- The budget provides $25,000 to Ohio domestic violence groups to give clients travel vouchers, gas cards and ridesharing credits.

- Millions of dollars will go toward the Foundation for Appalachian Ohio, as well as money for workforce development around the state and in Appalachian communities.

- The budget includes greater investments for maternal/infant health programs.

The budget does not include several major proposals from the governor, including gun safety reforms and a $50 million public relations campaign for Ohio.

***

Also from Ohio Capital Journal:

As in other states, Ohio might be running out of people who want shots

Some county health departments in Ohio are again telling state officials this week not to send them any more coronavirus vaccines. That’s because they haven’t been able to use up the supplies they already have.

It might be part of a national phenomenon. The news organization Axios reported this week on a paper by the Kaiser Family Foundation saying that based on its polling, just over 60% of Americans say they’ll get a vaccine.

“We estimate that across the U.S. as a whole we will likely reach a tipping point on vaccine enthusiasm in the next two to four weeks,” the paper said. “Once this happens, efforts to encourage vaccination will become much harder, presenting a challenge to reaching the levels of herd immunity that are expected to be needed.”

The paper conceded that the percentage of people willing to get a shot has crept up over time, so “61% may be a floor, not a ceiling.” READ MORE

Bill combines state test, changes third grade reading guarantee

A bipartisan bill introduced in the Ohio House seeks to reduce the number of end-of-course tests, make ACT/SAT tests voluntary and take the pressure off the third grade reading guarantee.

The cosponsors of the bill — state Rep. Gayle Manning, R-North Ridgeville, and state Rep. Erica Crawley, D-Columbus — said they hope to study the time tests take out of the learning process in schools to decide when testing becomes more of a stressor than a benefit.

“We’ve all been in the classroom, and my guess is none of you’ve fallen in love with a subject because of a test you took,” Manning, a former school teacher, told the House Primary and Secondary Committee while introducing the bill.

House Bill 73 eliminates two requirements: one that mandates high school students take “a nationally standardized college admission assessment,” and another that attaches the ability to hold a child back based on their scores on a third grade reading guarantee test. READ MORE